The End of Banking Waits: How WhatsApp is Changing the Game

In an era where time is of the essence, the traditional banking experience, characterized by long queues and extended waiting periods, is undergoing a significant transformation. At the heart of this change is WhatsApp, a tool that's redefining customer service and operational efficiency in the banking sector. This article explores the dynamic role WhatsApp is playing in reshaping how customers interact with their banks, making every transaction smoother and more personal.

The Challenge with Traditional Banking

For decades, customers have accepted the inevitality of waiting in line at banks for everything from simple inquiries to complex transactions. This not only consumed valuable time but also often led to a frustrating customer experience.

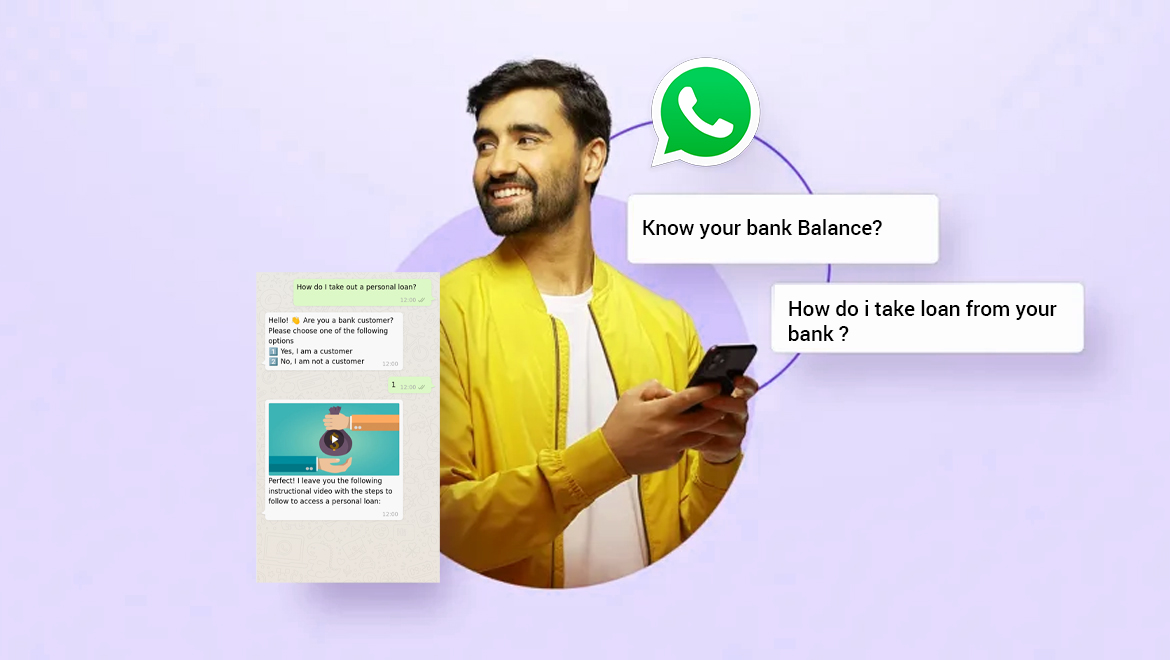

Enter WhatsApp: A New Era in Banking Communication

WhatsApp, with its global penetration and ease of use, is now being harnessed by forward-thinking banks to bring customer service into the digital age. This messaging platform is facilitating a shift towards more direct and efficient customer-bank interactions.

Instant Support and Inquiries

Gone are the days of waiting on hold to speak with a customer service representative. WhatsApp enables customers to get instant responses to their queries, ranging from account balances to transaction inquiries, all within a familiar chat interface.

Appointment Scheduling Made Easy

WhatsApp simplifies the process of scheduling appointments with banking officials, allowing customers to avoid unnecessary waits. Customers can now book, reschedule, or cancel appointments with just a few messages, streamlining their banking experience.

Secure and Personalized Banking at Your Fingertips

Security is paramount in banking, and WhatsApp's end-to-end encryption ensures that communications remain confidential. Personalization is also enhanced, as banks can send customized account updates, alerts, and even financial tips directly to customers' phones.

Automated Services through Chatbots

Many banks are integrating AI-driven chatbots within WhatsApp to provide 24/7 services, from answering FAQs to guiding customers through various banking processes, ensuring that help is always available, even outside of regular banking hours.

Document Sharing and Verification

WhatsApp allows for the secure sharing of documents and images, facilitating processes like identity verification and document submission without the need for a physical bank visit.

Feedback and Continuous Improvement

Banks are utilizing WhatsApp as a tool for collecting customer feedback, which is crucial for continual service improvement. This direct line of communication helps banks quickly address concerns and adapt to customer needs.

Challenges in Integration

While WhatsApp offers numerous benefits, banks face challenges in integrating it with existing systems, ensuring regulatory compliance, and maintaining data privacy. Overcoming these hurdles is key to unlocking the full potential of WhatsApp in banking.

Looking Ahead: The Future of Banking with WhatsApp

As banks continue to innovate, the role of WhatsApp is expected to expand, potentially including more complex transactions and integrations with banking apps, further enhancing customer experience and operational efficiency.

Conclusion

WhatsApp is revolutionizing the banking experience by eliminating long waits and bringing banking services directly to the customer's fingertips. This shift not only saves time but also enhances the overall customer experience, making banking more accessible, secure, and personalized. As banks continue to embrace digital tools like WhatsApp, the future of banking looks more convenient and customer-centric than ever before.